Posted on June 11, 2018 by GSCPA Admin

If your remuneration including reportable fringe benefits and salary sacrificed superannuation contributions is more than $250,000 pa, you may have an additional tax liability over and above the normal income tax payable on such earnings. Now that would be a substantial salary package, so it may seem like a good problem to have, but no-one likes an unexpected demand from the ATO.

It started about five years ago when the government introduced a rule called Division 293 to the tax system. Division 293 is intended to even out the effect that the concessional tax treatment of superannuation has for higher income earners compared to middle and lower income earners. This results from before-tax (known as concessional) super contributions being taxed at 15% within a fund, and the higher relative difference in marginal rates for high income earners compared to the average.

“If you are a high income earner, your marginal tax rate is higher than an average income earner,” the ATO says. “When you make concessional contributions to your fund, you receive a larger tax concession. Division 293 imposes an additional tax of 15% to bring the concession back to an amount in line with the average.”

Division 293 may be better explained by using the worked example that the ATO has provided.

“In the 2015-16 financial year Mark earns $320,000 and his employer contributes $20,000 to his superannuation fund. Mark’s fund pays tax of $3,000 on his contribution (15% × $20,000)”.

If Mark’s employer had not contributed to super, Mark would have earned $340,000 and the additional $20,000 would have been taxed at his marginal rate of 49%. Mark would have paid $9,800 tax on the additional $20,000. The tax concession Mark would receive on his contributions is $6,800.

“By paying Division 293 tax of $3,000 (15% × $20,000) Mark still receives a concession but it is reduced. The total amount of tax paid on the contribution is $6,000 (30% × $20,000, made up of 15% taxed in the fund and 15% Division 293 tax). The tax concession is now $3,800.”

When Division 293 was introduced in the 2013- 14 year (the legislation was called “Sustaining the superannuation contribution concession”), the threshold at which it applied was set at $300,000 annual income for each individual. However in contrast to some other income thresholds and limits, which can tend to go up, this has now reduced to $250,000 (from July 1, 2017).

That’s quite a drop in the threshold, and since it applies to the current financial year it is opportune to alert taxpayers to be circumspect as regards this aspect of taxation law.

So if you or yours are at or near the new threshold, be aware that this division could be another consideration in your possible tax liabilities. The ATO uses information from income tax returns and contributions reported by your super fund to work out if Division 293 applies, and if so, how much tax is owed. And remember, as income levels can move year to year, there is potentially an annual possibility of Division 293 tax being imposed.

Share this:

Posted on April 18, 2018 by GSCPA Admin

If you are an Australian resident and are thinking of moving overseas, or alternatively, if you are an Australian resident living overseas but thinking of moving back to Australia, what are the potential tax implications?

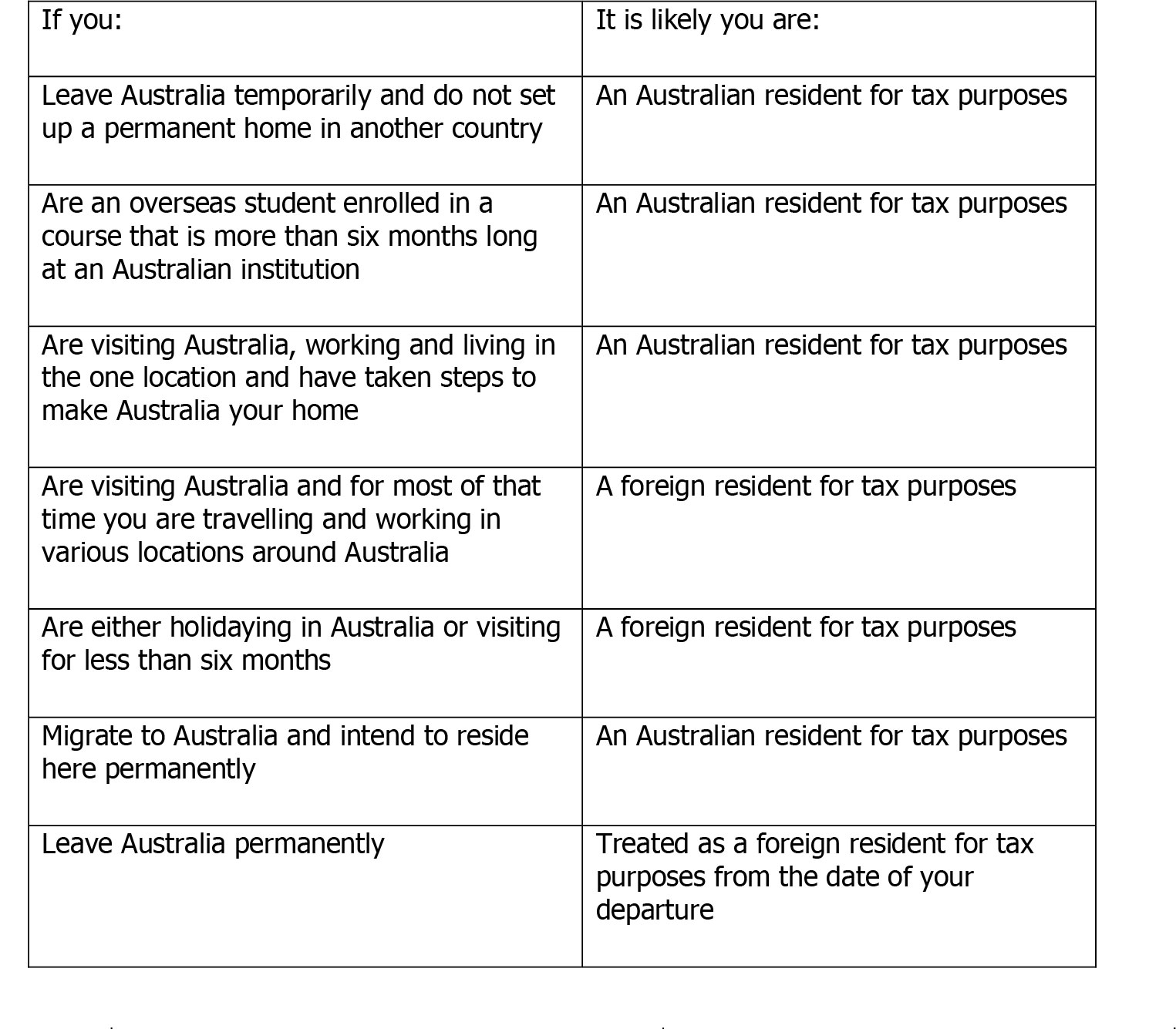

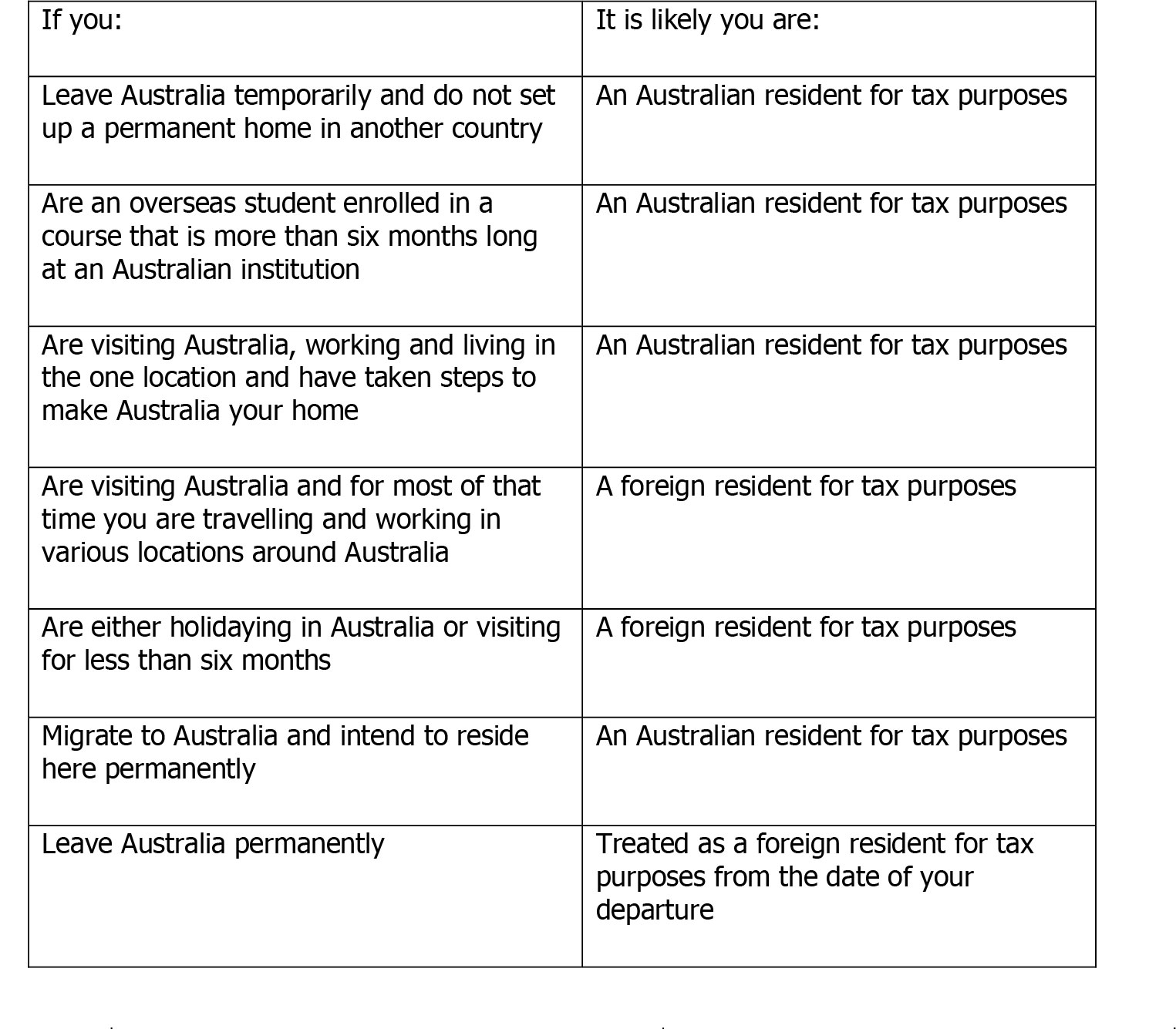

The first step is to determine whether you are an Australian or foreign resident for tax purposes. This may be different to your residency status for other purposes – for example, you may be an Australian resident for tax purposes even if you do not hold Australian citizenship or permanent residency.

Australian Residents for tax purposes

Tax implications of foreign income as an Australian resident for tax purposes?

As an Australian resident for tax purposes, all foreign sources of income must be declared in your tax return. This will include:

- foreign pensions and annuities

- foreign employment income

- foreign investment income

- foreign rental income

- foreign business income

- capital gains on overseas assets

It is likely that your foreign income will have been taxed in the source country that income was derived, potentially leading to double taxing of the same income. When completing your Australian tax return, any tax you have paid may be able to be claimed as a foreign income tax offset against your tax liability if there is a double agreement in place between the source country and Australia. There are also certain exemptions in place which you may be eligible for depending on your situation.

If you cease being an Australian resident for tax purposes

Foreign income tax implications if you are not an Australian resident for tax purposes?

You are only taxed on your Australian-sourced income, so you do not need to declare income you receive from outside Australia in your Australian tax return.

However, if you have a Higher Education Loan Program (HELP) or Trade Support Loan (TSL) debt and you’re a non-resident for tax purposes – you’ll need to declare your worldwide income or lodge a non-lodgement advice.

If you’re a non-resident you are not entitled to the tax-free threshold. This means you pay tax on every dollar of income you earn in Australia. If however, you were a resident for part of the year, you have a tax-free threshold of at least $13,464. The remaining $4,736 of the full tax-free threshold is pro-rated according to the number of months you were a resident.

CGT implications if you cease being an Australian resident for tax purposes?

If you have left Australia and kept your home as an investment, you may have potential Capital Gain implications. Changes to the current legislation were first announced in the 2017 Federal Budget which delivered a blow to foreign residents and expats with the removal of the Main Residence Exemption for foreign and temporary residents of Australia. Currently this legislation is before the Senate but it is expected that there will be no substantial changes to the proposed legislation.

The proposed legislation changes are that if you a non-resident on the date the contract of sale for an Australian property is signed (as opposed to settlement date), you will be subject to Capital Gains Tax (CGT) on 100% of the capital gain incurred. For existing properties held before 7:30pm on 9 May 2017 there are grandfather provisions available until 30 June 2019. It would be beneficial for any expat that still holds their main residence in Australia to seek advice in relation to whether they should sell their property prior to 30 June 2019, especially if there is any doubt that they will be returning to Australia to live before this date.

Share this: