Superannuation changes from 1 July 2017

Posted on 2nd August 2017 by Christabelle Harris

There are a number of changes to Superannuation that came into effect from 1 July 2017. It’s important that you are aware of how these changes might affect you.

Concessional Contribution Cap

A Concessional Contribution is any contribution made into your superannuation account where the contributor claimed a tax deduction for making the contribution. The general tax rate on Concessional Contributions (Contributions Tax), is 15%.

Types of Concessional Contributions include:

- Employer Superannuation Guarantee (SG) Contributions (mandatory employer contributions)

- Salary Sacrifice Contributions

- Personal Concessional Contributions

Mandated Employer Contributions (such as employer SG contributions) can be received by anyone of any age.

Salary Sacrifice contributions and other employer contributions (in excess of mandatory employer contributions) can be made up until age 74; however if you are 65 years or over you must meet the superannuation work test (of working at least 40 hours in 30 consecutive days).

For the 2018 financial year, the concessional contributions cap is $25,000 for all age groups. This is a reduction from the 2017 financial year cap of $35,000 for individuals aged 49 years or over and $30,000 for those under age 49.

Personal Concessional Contributions

Prior to 1 July 2017, Personal Concessional (deductible) Contributions have only been available to self-employed persons, or substantially self-employed persons meeting the 10% rule. Employees were only able to make pre-tax contributions via a salary sacrifice arrangement with their employer.

However, both employees and self-employed persons will be able to make Personal Concessional Contributions from 1 July 2017. A tax deduction can be claimed for the contribution amount equal to the amount contributed in your personal tax return.

This change is designed to benefit those who are partially self-employed and partially wage or salary earners and those whose employers do not offer salary sacrifice arrangements.

Personal Concessional Contributions can be made up until age 74; however the work test must be met if you are 65 years or over

Non Concessional Contribution Cap 2017/2018

A Non-Concessional Contribution is an after-tax contribution made into superannuation. Unlike a Concessional Contribution, a tax deduction cannot be claimed for Non-Concessional Contributions and they form part of the ‘tax-free component‘ of your superannuation savings.

The Non-Concessional Cap in the 2017 financial year was $180,000; however this was reduced to $100,000 p.a. from 1 July 2017.

You can only make non-concessional contributions from 1 July 2017 if your total superannuation balance is less than $1.6m.

If you are between 65 and 74, you are eligible to make Non-Concessional Contributions provided you meet the work test. Once you reach age 75, you are no longer able to make Non-Concessional Contributions.

Non-Concessional Contribution Cap & Bring Forward Rule

If you are under 65, you may be able to make non-concessional contributions of up to three times the annual non-concessional contributions cap in a single year. If eligible, when you make contributions greater than the annual cap, you automatically gain access to future year caps. This is known as the ‘bring-forward rule’.

For example, as of 1 July 2017, the Non-Concessional Contribution cap is $100,000. Therefore, $300,000 can be contributed over a 3 year period at any stage.

You are only able to utilise the bring forward rule in a financial year that you were aged 64 or lower for at least one day. As such, the bring forward rule cannot be employed by a person aged 65 or more for the full financial year.

Please be aware that transitional arrangements apply if you triggered a bring forward in either the 2016 or 2017 financial years. If you have triggered a bring forward before 1 July 2017 and you have not fully utilised your bring-forward cap before 1 July 2017, your cap will be reassessed on 1 July 2017 to reflect the new reduced annual cap.

Non Concessional Contribution Maximum Balance

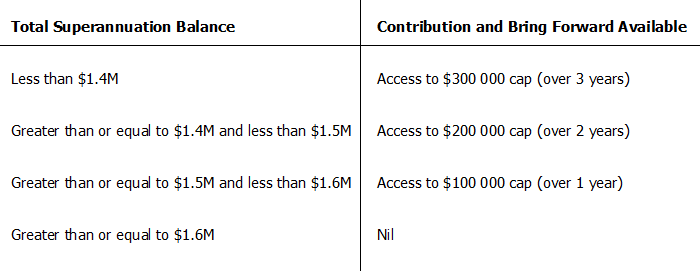

As of 1 July 2017, you are unable to make Non-Concessional Contributions to superannuation if your total superannuation balance exceeds $1.6 million.

Further, if your balance is greater than $1.6 million on 30 June of each year, your bring forward rule cap is reduced to zero in the following year, as shown below:

Contributions Tax for High Income Earners

Division 293 Tax is an additional Contributions Tax that applies only to high income earners. The Division 293 Tax imposes an additional 15% Contributions Tax on Concessional Contributions received into the superannuation account of a high income earner.

In the 2017 financial year, a high income earner was someone whose income for surcharge purposes and their super contributions exceeded $300,000. As of 1 July 2017, the income level for the application of the Division 293 Tax will reduce to $250,000.

Low Income Super Tax Offset for Low Income Earners

The low income super contribution (LISC) is a government superannuation payment of up to $500 to help low-income earners save for retirement. The low income super contribution (LISC) has been repealed from 1 July 2017 and will be replaced by the low income super tax offset (LISTO).

Individuals with an adjusted taxable income up to $37,000 will receive a refund into their superannuation account of the tax paid on their concessional superannuation contributions, up to a cap of $500.

In effect, this means that most low income earners will pay no tax on their superannuation contributions.

Super co-contributions

If you are a low or middle-income earner and make non concessional super contributions to your super fund, the government also makes a co-contribution up to a maximum amount of $500.

The amount of government co-contribution you receive depends on your income and how much you contribute.

From the 2017–18 financial year, to be eligible for a co-contribution:

- you must have a Total Superannuation Balance less than the general transfer balance cap for that year (currently $1.6m);

- the contribution you made to your super fund must not exceed your non-concessional contributions cap for that year

Other eligibility requirements also apply.

Spouse tax offset

Currently a member can claim a tax offset up to a maximum of $540 for contributions they make to their low-income spouse’s eligible super fund.

From 1 July 2017, the spouse’s income threshold will be increased from $13,800 to $40,000. The current 18% tax offset of up to $540 will remain as is and will be available for any member, whether married or de facto, contributing to a recipient spouse whose income is up to $37,000. As is currently the case, the offset is gradually reduced for income above this level and completely phases out at income above $40,000.

Members will not be entitled to the tax offset when the spouse receiving the contribution has exceeded their non-concessional contributions cap for the relevant year, or has a total superannuation balance of $1.6m or more.

The intent of this change is to extend the current spouse tax offset to assist more couples to support each other in saving for retirement. This will better target super tax concessions to low-income earners and people with interrupted work patterns.

Please contact our Superannuation Manager Helen Cooper on (08) 9316 7000 should you wish to discuss your specific circumstances in more detail.

Any information provided in this article is purely factual in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and was not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001.