Succession Planning – How do you maximise the value of your business and exit when you want to?

Posted on 6th March 2018 by Andrew Sullivan

Succession planning is often something business owners don’t consider until it is too late.

Succession planning allows business owners to plan for the eventual sale of their business. By doing so, they sell on their terms, in their time frame and maximise the value they receive for the sale.

If you intend to sell your business one day, the three questions you need to ask are:

- Who am I selling my business to / what type of sale am I undertaking?

- How do I maximise the value of the sale?

- Am I prepared for what happens after the sale?

Who am I selling to?

There are a number of different options when exiting your business:

- Keep in the family and transfer to the next generation,

- Sell to employees,

- Trade sale – i.e. sell to an external buyer,

- List on the Share Market,

- Simply wind down and close the doors

In each of the options above it is critical to prepare your business to allow for the exit option you have chosen and to maximise your sale value in the process. By being proactive and preparing your business for sale specifically to the type of buyer you have identified, you will maximise the sale value. Leaving this to chance by deciding to sell your business without preparation and then hoping the right buyer turns up is a risky strategy and one that will result in a lower value than a prepared seller will achieve.

How do I maximise the value of the sale?

The value of a business is always determined by what someone is prepared to pay for it. To create an attractive business that is in high demand for the type of buyer you have identified, which will in turn achieve a high value for the seller, there are 5 key factors that must exist:

- Great culture and team

- Great product

- Great customers / clients

- Efficiency and profitability of the business

- Management separate from / not reliant on ownership

Great culture and team, great products sold by the business and great customers are all interdependent – you will not have one without the others. These three elements will ensure that you operate at the premium end of the market, which is attractive to a buyer of your business.

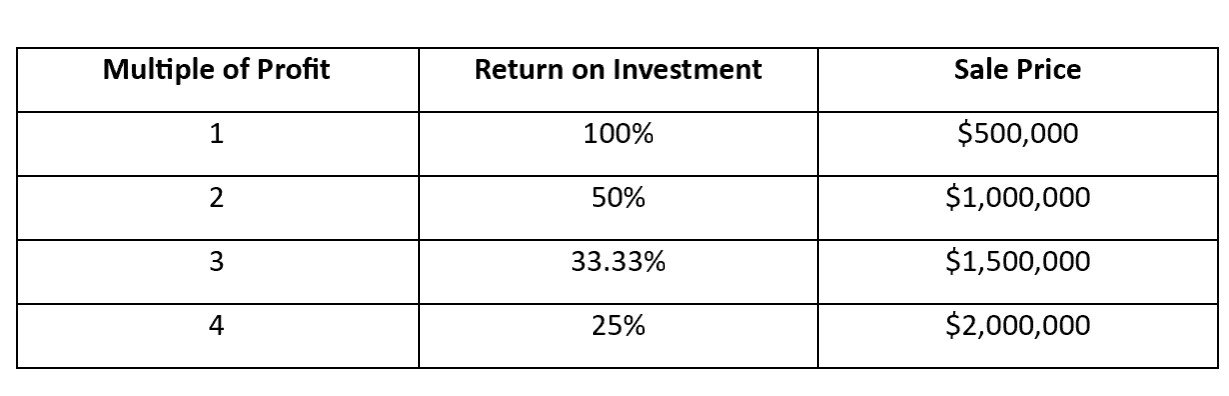

The efficiency and profitability of the business impacts the value of the business (sale price) as a business is sold on its “multiple of profit” / return on investment (ROI). This means that if a business is sold for 3 times its profit, then the owner will receive a sale price of $3 for every $1 of profit the business makes. As you can see improving the profit of the business will then greatly improve the sale price.

The size of the multiple of profit is also greatly increased when the business is not reliant on the owner to operate successfully. As a business owner, imagine that your business is not reliant on you to operate successfully. This would mean that you have created time for yourself to take a decent holiday, to spend time with your family, to pursue other interests or to work on improving your business further now that you aren’t caught up in the day to day of the business. Having a strong management team will help you to achieve this.

From the buyer’s point of view the business is an attractive investment that they will also work to develop, as opposed to buying a business that will not function without the owner (ie “buying a job”).

This is one of the main reasons that the share prices of ASX listed companies are 10 to 20 times the profit of the company. Most SME’s sell for between 1 and 3 times their profit.

Another key component is structuring correctly to minimise the tax on sale. If structured correctly and planned for well, it is possible to pay no tax on the sale.

The table below shows the same type of business, with a profit of $500,000, being sold at various multiples of profit / ROIs

Am I prepared for what happens after the sale?

For many business owners, their business is a big part of what defines them. It has been the place they go every day. It has been their purpose.

What happens when someone else owns “their” business and these things no longer exist for them?

It is just as important to prepare yourself for after the sale as it is to prepare your business for the sale.

We find that as the management team develops and the owner is needed less and less every day, the owner should take some of their new-found time to pursue other interests both personal and professional so that after the business sale they are ready to begin a fulfilling next chapter of their career and life.

What should you do next?

Succession planning should start a minimum of 5 years before you wish to sell any percentage of your business. It takes time to prepare a business thoroughly to create the maximum value in a sale.

Imagine that by identifying the right buyer, improving your business’ efficiency and profitability, having a loyal and passionate team and creating strong management meant you didn’t have to come to work every day and you could double or triple the value of your business when you do eventually sell.

What if you aren’t ready to sell your business in the next 5 years, but instead just wanted to have a less stressful business, enjoy your business more and improve your profitability – doing all of the things above will achieve that as well.

We have many examples of clients that we have worked with and are currently working with where we have assisted them to:

- Improve the profitability of their business,

- Improve their cashflow,

- Improve their business systems,

- Create more time for them by helping develop their management team, so their business is not reliant on them,

- Help identify the right type of buyer to maximise their sale value, and

- Structure their entity and sale, tax effectively, to minimise the tax paid on sale (in many cases to nil!).

Please call us on (08) 9316 7000 and speak with: