Single Touch Payroll – Small Employers Closely Held (Related)

Posted on 30th July 2021 by Ashley Dawson

What is Single Touch Payroll?

Single Touch Payroll (STP), is an Australian Government initiative to reduce employers’ reporting burdens to government agencies. This allows employers to report employees’ payroll information to the ATO each time a payment is processed. Payroll Information includes:

- Salary & Wages

- Pay as you go (PAYG) withholding

- Employer Superannuation Contributions

Single touch payroll was rolled out on the 1st July 2018 for business’ with 20 or more employees and 1 July 2019 for business’ with 19 or fewer employees.

As these entities have now been reporting for over a full financial year, it is now time for closely held payees to get STP ready.

As of 1 July 2021 Closely Held (Related) Payees will need to be reported through STP. This also includes a number of other concessional reporting entities such as:

- Agriculture, fishing and forestry industry

- Not-for-profit clubs and associates

- Season and intermittent employers

- Inbound assignees

Who are closely held payees?

Closely held payee is an individual who directly related to the entity from which they receive payments. Examples are:

- Family members working in a family business

- Beneficiaries of a trust

- Director or shareholders of a company

Ways to report your closely held payees

From 1 July 2021, you are able to report payments of wages to closely held employees through STP in the following ways:

- Report actual payments on or before the date of payment, as with all other employees

- Report actual payments quarterly. I.e report payroll information when your activity statement is due for that quarter

- Report a reasonable estimate quarterly. Report amounts equal or greater than a percentage of gross payments and tax withheld from latest year, across each quarter

Reporting Payments Quarterly

Small employers can choose to report their closely held payees on a quarterly basis.

If this method is chosen, your quarterly STP report is due on or before the date of your quarterly business activity statement.

This does not change the due dates for any PAYG withholding or super guarantee charges for closely held employees.

Reporting a reasonable estimate

Closely held payees drawing money from their business can elect to make a reasonable estimate of gross wages each quarter based on their prior year gross wage.

The ATO will remit any failure to withhold penalty employers may incur if:

- Year to date reporting amount and tax withheld for closely held payees is equal to or greater than 25% of payee’s total gross payments and tax withheld from previously payment summary annual report. They can then complete a final adjustment in the 4th STP quarter to bring the year-to-date reporting in line with their total wages.

- Report and pay the PAYG withheld to the ATO on time.

An example of this is demonstrated below:

Grant Pty Ltd has chosen to start reporting their closely held payees using the reasonable estimate method.

Sean, the closely held employee received a gross wage of $80,000 in the 2021 financial year.

Grant Pty Ltd reports $20,000 each quarter for the first three quarters of the 2021 financial year. This is 25% of Sean’s 2021 $80,000 gross wage.

Grant Pty Ltd realises in the 4th STP event Sean will receive $90,000 of gross wages for the 2021 financial year, not the $80,000 as estimated. Therefore, Grant Pty Ltd will report $30,000 of wages in the 4th STP quarter of the 2022 financial year to bring his gross wages in line.

If Grant Pty Ltd chooses to use the reasonable estimate method for the 2023 financial year, the reasonable estimate for the first 3 quarters will be $22,500 and make a wage adjustment accordingly in the 4th STP quarter.

However, if payments made equal more than 25% of payees gross payments for last financial year and the employer did not report this through STP this omission may cause:

- Unpaid super and therefore super guarantee charge liability for the relevant quarters, requiring SGC statements to be lodged,

- Not be able to deduct the payment of super as it will be deemed late,

- Be liability for penalties and interest.

Finalisation declaration due date for closely held payee

Small employers with only closely held payees (shareholders of a company or beneficiaries of a trust) have up until the due date of the closely held payee’s individual income tax return to make a finalisation declaration for a closely held payee.

For arm’s length employees the due date is the 14th July.

How to lodge your STP reports

To lodge your STP reports for closely held employees you will need STP enabled software, the same as for arm’s length employees. This is the same for reporting actual payments, reporting actual quarterly payments and reasonable quarterly estimates. If you are reporting wages using the quarterly or reasonable estimate method, you will need to ensure the closely held employee’s payroll settings are set up on a quarterly cycle. Then when it is time to process the quarterly pay run, your STP enable software will recognise it is time to report their wages. The gross wages and PAYG will then need to be reported on your quarterly BAS.

Depending on the STP software, your lodged STP report may include both arm’s length employees and closely held payees the reports may be prepared and lodged separately.

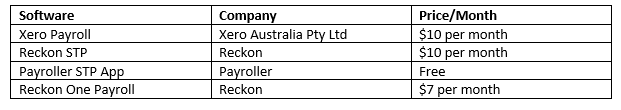

Suitable no/low cost STP software’s

The below STP enabled software for small employers is a sample of the available packages.

All of our staff at GeersSullivan are trained in the use of STP software and are Certified Xero Payroll Experts. If you are unsure of anything regarding setting up, reporting or finalizing your payroll affairs please reach out as soon as possible so we can help you manage this critical component of your reporting to the ATO.