HOW YOUR PRIVATE HEALTH INSURANCE IMPACTS YOUR TAX RETURN

Posted on September 22, 2017 by Kelsi KeepYour private health insurance can impact two main items on your Income Tax Return, these include:

- The Private Health Insurance Rebate; and

- The Medicare Levy Surcharge.

The Private Health Insurance Rebate

The Private Health Insurance rebate is an amount that the government contributes towards your private hospital health insurance premiums.

The private health insurance rebate can be received:

- as a premium reduction, which lowers the policy price charged by your insurer; or

- as a refundable tax offset when you lodge your tax return.

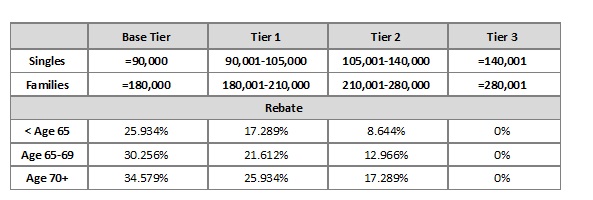

Your entitlement to the rebate is determined based on your income for Medicare Levy Surcharge purposes (discussed later in this article). The table below illustrates the four tiers, the relevant income thresholds for singles and families and the applicable rebate rates.

Note:

- Single parents and couples (including de facto couples) are subject to family tiers

- The thresholds are increased by $1,500 for families with children for each child after the first

- The rebate applies to hospital, general treatment and ambulance policies

- The rebate does not apply to overseas visitors cover

- The rebate percentages above will apply to premiums paid from 1 April 2017 until 31 March 2018.

- In March 2018, the Department of Health will announce the rebate percentages for premiums paid from 1 April 2018 to 31 March 2019

When you lodge your tax return, we will calculate your entitlement to receive a private health insurance rebate.

If you claim your rebate as reduced private health insurance premiums it is important that your Private Health Insurer is aware of which Tier is applicable to you, as this information is not provided to them by the ATO. If you receive more rebate than you are entitled to via reduced private health insurance premiums, the ATO will claim back the excess rebate when you lodge your tax return. This amount will be shown on your tax return as an ‘Excess private health reduction’.

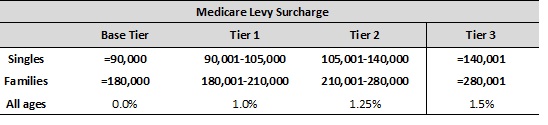

The Medicare Levy Surcharge (MLS)

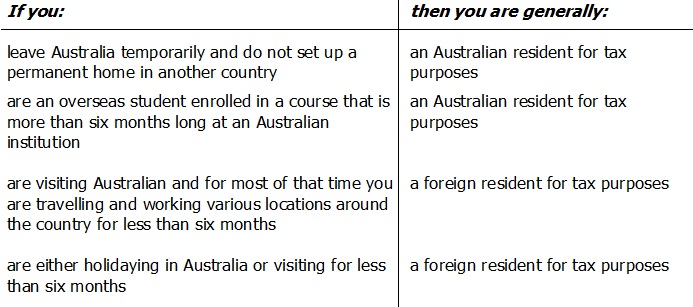

If you or your family do not have an appropriate level of private hospital insurance cover, and your income for MLS purposes is above a certain threshold, you will be required to pay the MLS. The MLS applies unless you are exempt from paying the Medicare levy as you are a dependant or you satisfy the requirements of one of the following categories:

- Category 1: Medical exemption

- Category 2: Foreign residents exemption

- Category 3: Not entitled to Medicare benefits

The table below details the relevant surcharge amounts based on your income level for MLS purposes.

Note: The rebate percentage is adjusted on 1 April each year.

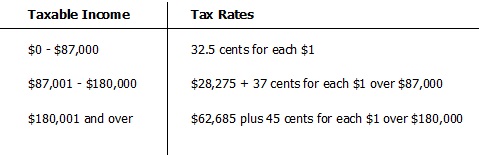

Your Income for Medicare Levy Surcharge purposes (applicable for calculating the Private Health Insurance Rebate and the Medicare Levy Surcharge) is the sum of:

- your taxable income

- your reportable fringe benefits

- your total net investment losses (including rental property losses)

- your reportable super contributions (including deductible personal super contributions)

If you are between your preservation age and 59 years old, you subtract from the total (above) any taxed element of a super lump sum (other than a death benefit) which you received that does not exceed your low-rate cap.

Your family income for surcharge purposes is the combination of your income and that of your spouse, using the abovementioned criteria.