ATO Targeting “Landlords”

Posted on 11th June 2018 by Tom Francis

Rental property owners are once again in the sights of the ATO in 2018 as they plan to crack down on landlords who wrongly claim tax deductions on their personal holiday homes. And they have some staggering figures to justify their interest, such as one Victorian tax payer who attempted to claim $760,000 of expenses on a property that was used by the tax payer and his friends for 87% of the year. The ATO were able to reliably estimate this figure based on the property’s listing on a holiday home website that clearly showed block out periods where the home was not available.

While the headlines are all about holiday homes, we believe tax payers who charge a low rate of rent to help family members such as kids studying full time can also expect some extra ATO scrutiny this year. This is because the ATO systems pick investigation targets based on ratios of income to expenses in the first instance and the ATO have shown a new willingness to issue ‘please explain’ letters en masse.

To help our clients manage this risk we implement the following strategies which can easily be applied to a holiday home or below-market rental:

Apportioning Your Expenses

Under this method the expenses claimed against your rental income are reduced by a percentage to allow for the private use component. We recommend this method where a property is rented at a market rate for part of the year and used privately (or leased out for no charge to friends and family) for the remainder.

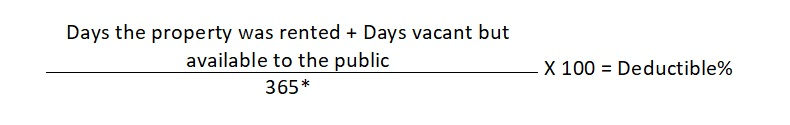

The formula to calculate the deductible percentage of your expenses is as follows:

The deductible percentage will apply to all expenses claimed against rental income in that financial year and is re-calculated each year based on occupancy.

Substitute a market rate of rent

Under this method the actual rent received is not included in your tax return, instead the expected rent from offering the property to the public for the full year is included. For example, a landlord with a property that should rent for $200 a week will include $10,400 as rental income in their tax return. No adjustment is made to the expenses incurred to maintain and operate the property, they are included in the landlord’s tax return as normal.

We recommend this method where:

- A property was rented at a below market rate to a related party (for example where Mum and Dad rent their property to their kids whilst they study at university for a cheap rate)

- A property was rented for part of the year to the public, part private use and partly to related parties without consideration for market value

- A property which had previously been a market rental is being used by a family member on a temporary basis and no rent is being charged

- No records have been kept as to the days available for rent to the public vs days of private use

It should be noted though that a property which has never been available for rent to the public cannot be treated as a rental if it is only used for private purposes. It is also possible for expenses incurred during a period of private use to be added to the cost base of an asset, so it is still important to keep accurate records each year.

*Where the property was purchased or sold during the financial year, this number will be the days the property was held during the year