Posted on August 2, 2017 by Ashley Dawson

In line with tradition GeersSullivan celebrated the dawning of the new financial year with a party for staff and partners.

This year’s End of Financial Year party was held at Bar Lafayette in the city which was a more intimate space compared to previous events. The night was spent mingling reflecting on the past year and looking forward to the challenges ahead. Everyone was dressed to impress and enjoyed the delicious tapas, desserts and drinks.

As we wrap up the 2017 financial year, on behalf of all of us at GeersSullivan, we would like to thank you for your continued support and look forward to working closely with you in the 2018 financial year.

Share this:

Posted on August 1, 2017 by Ashley Dawson

Q: Am I a non-resident for tax purposes?

A: The ATO do not use the same rules as the Department of Immigration when determining your residency status. You can still be a resident for tax purposes even without being an Australian Citizen.

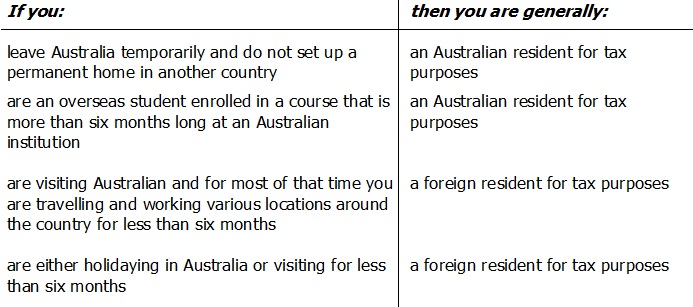

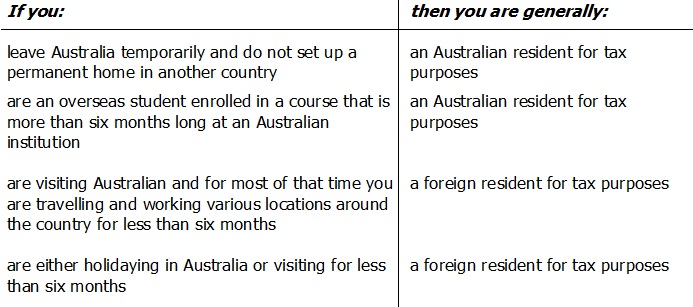

Below are some common situations that often apply when determining if you are an Australian resident or a non-resident for tax purposes:

Q: What do I have to declare in my tax return if I am a non-resident?

A: If you have been confirmed as a non-resident for tax purposes, you must declare any income earned in Australia including the following:

- Employment or wages income;

- Australian pensions or annuities;

- Rental Income;

- Any capital gains on Australian assets.

If you have a Higher Education Loan Program (HELP) or a Trade Support Loan (TSL) entered into while acting as a non-resident for tax purposes, you will need to declare your worldwide income or lodge a non-lodgement advice form.

Q: What tax rates apply if I am a non-resident for tax purposes but have earnt income from an Australian source?

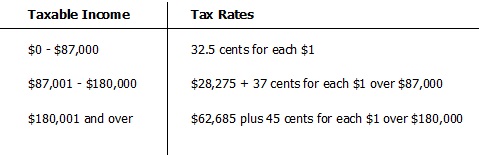

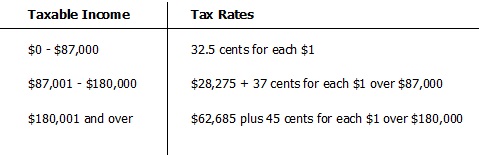

A: For the 2016-2017 financial year, the following rates apply for individuals who are non-residents for tax purposes:

It is important to note that non-residents are not required to pay the Medicare Levy. However the Temporary Budget Repair Levy is still payable at a rate of 2% for taxable incomes over $180,000.

Share this: