Posted on October 25, 2019 by Chris Grieve

Once again Chris and Tom headed up to the Kimberley region to visit their clients in our beautiful north as well as attend the Annual General Meeting of the Kimberley Aboriginal Law & Culture Centre (KALACC).

Prior to heading out to the AGM, they made a quick stop in Broome to visit a client who operates a newly established health and safety risk operation and organise a quick meeting with another Broome local who wanted assistance with purchasing a commercial property using borrowings inside their Self-Managed Superfund.

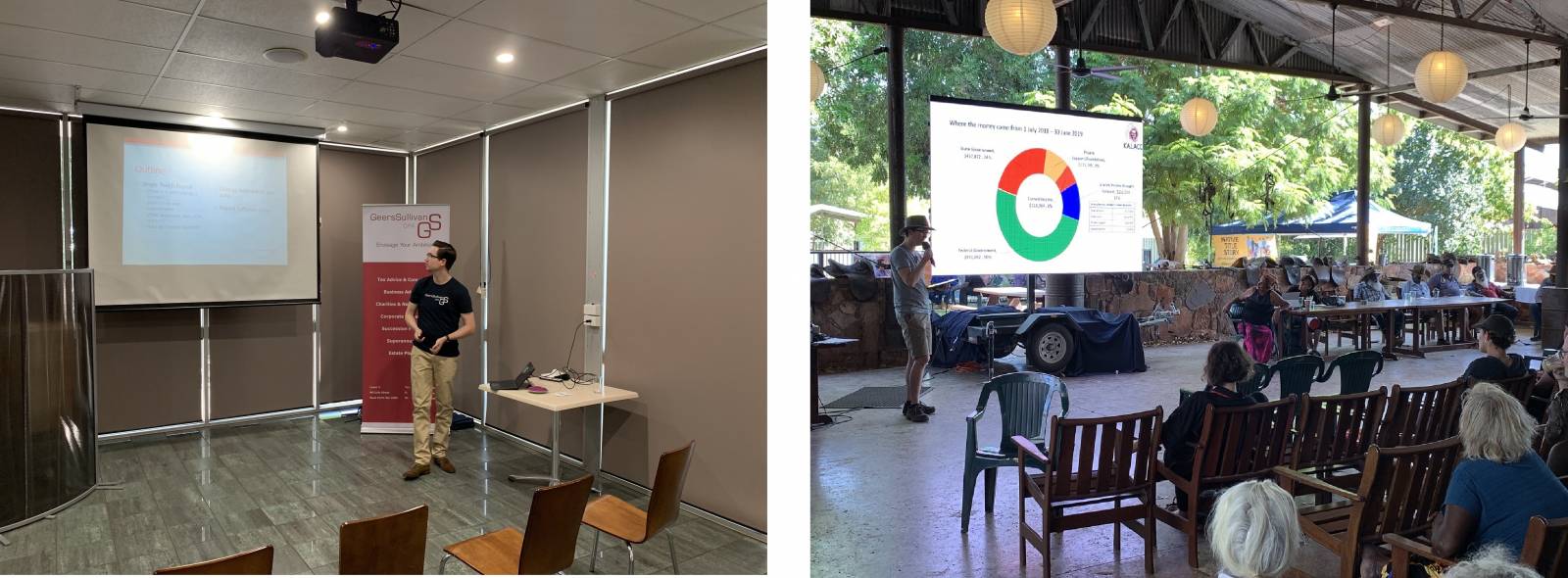

Then it was a quick flight over to Kununurra where a very busy schedule awaited them. After a two hour drive they were greeted at the beautiful Home Valley Station with a traditional smoking ceremony. The following day they attended the KALACC AGM at which Tom presented a summary of the financial year results to the board, the members and various stakeholders. The drive back to Kununurra was extended when they had to stop and change a tyre on the Gibb River Road. It is understood that like a true leader Chris pulled rank and “kept a lookout” whilst Tom did all the dirty work under the car. Throughout the following day Chris and Tom presented two seminars to the local business community on Single Touch Payroll and How To Use Your Financial Information to Improve Your Business Performance.

In keeping with the theme of delays in travel the flight home had to make an extra stop in Newman to refuel meaning a late night getting back to Perth.

Thank you to all our clients in the Kimberley region for your ongoing support and your hospitality. We feel privileged to have the opportunity to see such an amazing part of our state and look forward to seeing you again soon.

Share this:

Posted on by Chris Grieve

Much has been written of late on the impact of Artificial Intelligence (AI) on all facets of our lives. Our industry is not immune to this and in our view has and will continue to benefit greatly from further technological progress.

At GeersSullivan we have always embraced change as we look for new ways to provide a better customer experience and break the mould of the traditional accountant looking in the rear-view mirror at historical data.

Two years ago, we implemented a paperless document management system and changed our internal software in both our compliance and superannuation areas of our business. Not only have we reduced our environmental impact as we reduce the amount of printed paper, but it has allowed us to lease less space as the old compactus filing cabinet room was no longer required. As we look to the future, we will be working with our clients who also wish to have their final reports provided in a paperless format.

The introduction of more reliable AI accounting software encouraged us to rethink what an accountant is to our existing and prospective clients and how our tech savvy team could use the benefits of the various software packages to take on the role of internal bookkeeper and external CFO to assist our clients to:

- Extract meaning from their accounting numbers

- Set goals

- Establish strategies to achieve these goals; and

- Measure the progress toward these goals

The above is in addition to our traditional services of attending to the various compliance activities required by the Australian Taxation Office, ASIC and the Office of State Revenue (to name a few).

We at GeersSullivan have developed our End to End service which has been extremely well received by many of our existing clients already. This service includes:

- Bookkeeping services – data entry, accounts payable, accounts receivable, managing payroll via the new Single Touch Payroll system, paying superannuation obligations.

- Periodic reporting on the Key Performance indicators of your business – this involves developing a report tailored to your businesses specific KPI’s and reporting on these in an understandable and timely basis.

- Periodic business meeting – this meeting is with one of our senior staff who acts as an external Chief Financial Officer and mentor to discuss the performance of the business and hold you, the owner accountable for implementing the previously agreed strategies.

- Tax planning – estimating the year end results and final tax position of the group and recommending actions to minimise tax.

- Attending to all the ongoing compliance needs – including preparation of year end financial statements and tax returns, lodging BAS’ and IAS’, preparing Fringe Benefits Tax Returns and payroll tax returns.

The above further develops our strengths and experience in compliance and advisory services and packages it in an affordable monthly fee. To be this involved requires a suitable accounting software package and as a Xero Gold partner we recommend this product however we also are experienced in many other major software providers such as MYOB, Reckon/Quickbooks, Exonet, Sage and Netsuite.

We understand that some clients may wish to take advantage of all or some of the above and as such we are flexible in building a package that suits your business needs.

Call us today to discuss how we can help reduce the time you spend on bookkeeping and focussing your attention on achieving your goals.

Share this: