Posted on July 21, 2020 by Chris Grieve

Prime Minister Scott Morrison and Treasurer Josh Frydenberg have announced that the current $1,500 per fortnight JobKeeper payment will be reduced to $1,200 per fortnight from 28 September, and $750 per fortnight for employees working less than 20 hours a week.

From 4 January, the rates will again reduce to $1,000 per fortnight, and $650 for people working less than 20 hours a week with the support ending on 28 March 2021.

NEW ELIGIBILITY TESTS

Treasury also announced a revised eligibility test for businesses looking to remain on JobKeeper beyond September.

Businesses will still be required to demonstrate the required reduction in turnover- 30 per cent for businesses with turnovers of $1 billion or less, 50 per cent for those with turnover of more than $1 billion, and 15 per cent for ACNC-registered charities. However, the government will now require businesses to reapply the tests for the June and September quarters to be eligible for extended version of JobKeeper beyond September.

We will continue to monitor the announcements as more detail for eligibility tests are released and advise you accordingly.

If you or someone you know requires assistance please contact our office on (08) 9316 7000 and we would be happy to assist.

Share this:

Posted on June 16, 2020 by Tashia Jayasekera

The classification between employee or contractor affects your tax, super obligations and could even bring about penalties if you get it wrong. It comes down to asking the right questions and weighing up the circumstances of your working arrangement.

What is the difference between an employee and a contractor?

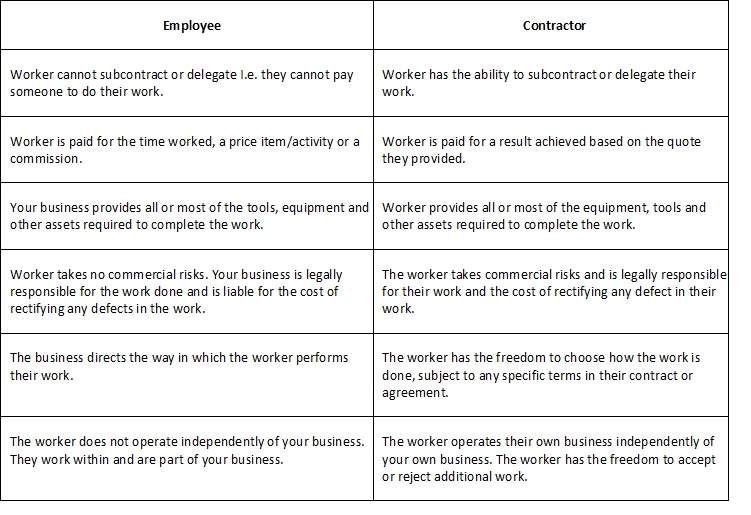

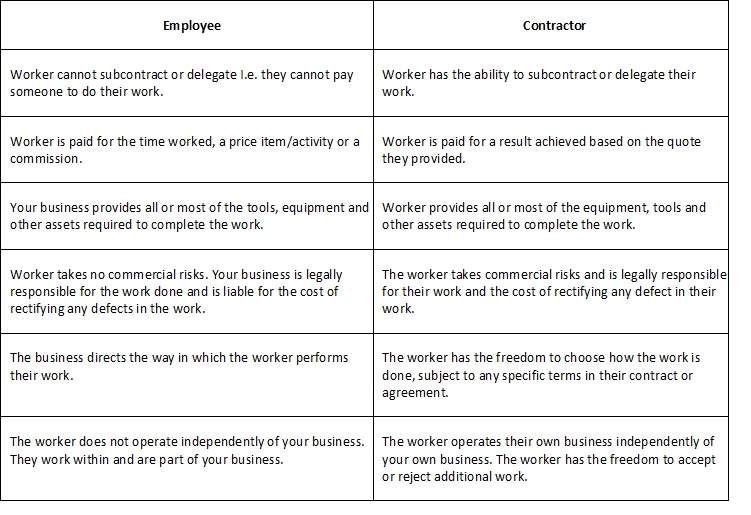

The table below outlines some of the main factors that can help you determine whether a worker is an employee or a contractor. These factors should be taken together as no one feature will guarantee that a worker is an employee.

Are any workers always employees?

Any of the following types of workers are always treated as employees:

- Apprentices

- Trainees

- Labourers

- Trades assistants

Apprentices and trainees can be full-time, part-time or school-based. They usually have a formal training agreement in place with the business they work for and are paid under an award and receive specific pay and conditions. The work arrangements for trainees and apprentices is always employment and you must meet the same tax and super obligations as you do for any other employees of your business.

Are any workers always contractors?

An employee must be a person. If you have hired a company, trust or partnership to do the work then it will be a contracting relationship.

What about labour hire arrangements?

If you have obtained a worker through a labour hire firm and pay that firm for the work performed at your business, then your business has a contract with the labour hire firm. The labour hire firm will be responsible for that worker’s PAYG withholding, super and Fringe Benefits Tax (FBT) obligations.

What are the tax and super obligations for an employee vs a contractor?

If your worker is an employee, you will need to:

- Withhold tax (PAYG withholding) from their wages and report this to the ATO

- Pay super at least quarterly to eligible employees

- Report and pay FBT if you provide your employee with fringe benefits

If your worker is a contractor:

- You do not need to withhold tax from their payments unless they don’t quote their ABN to you or you have a voluntary agreement in place with them

- You may still have to pay super for individual contractors if the contract is principally for their labour

- You do not have FBT obligations

What are the penalties for getting it wrong?

It is the against the law for a business to incorrectly treat their employees as contractors. Businesses that do this lower their labour costs by avoiding their tax and super obligations and denying workers their employee entitlements.

Some of the penalties and charges include:

- PAYG withholding penalty – for failing to deduct tax from worker payments

- Super guarantee shortfall amounts – the amount of super obligations that should have been paid to a complying super fund

- Interest charges

- Administration fees

- An additional super guarantee charge of up to 200%

If you have any questions about the employment or contracting relationship with any of your workers, please contact one of our Team on (08) 9316 7000.

Share this: