Posted on November 27, 2018 by Ashley Dawson

Recently the Australian Taxation Office (ATO) has updated their on-line guidance in relation to home office expenses for both, employees working from home and for businesses being operated from home. The biggest change to the guidance is the requirement for a taxpayer to maintain at least a 4 week diary of home office use that is representative of the whole of the year or otherwise keep records of actual work related home office use for the whole year, if you are claiming home running costs under the fixed rate method.

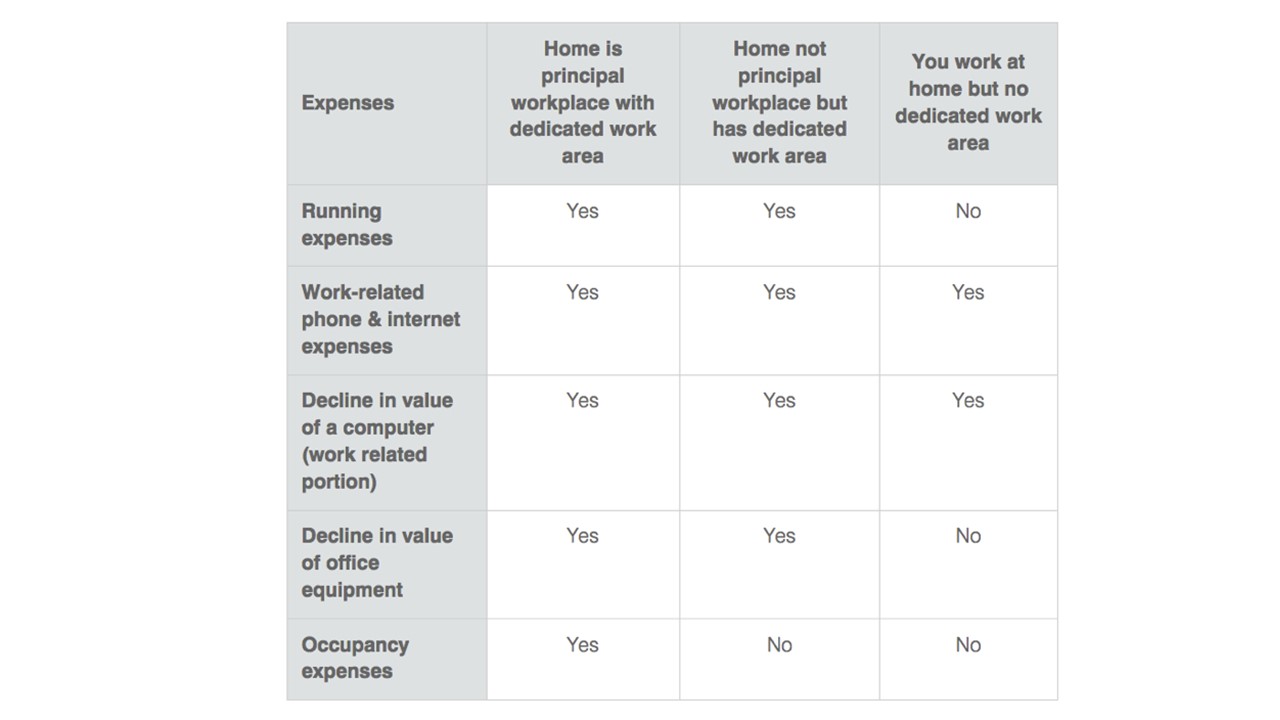

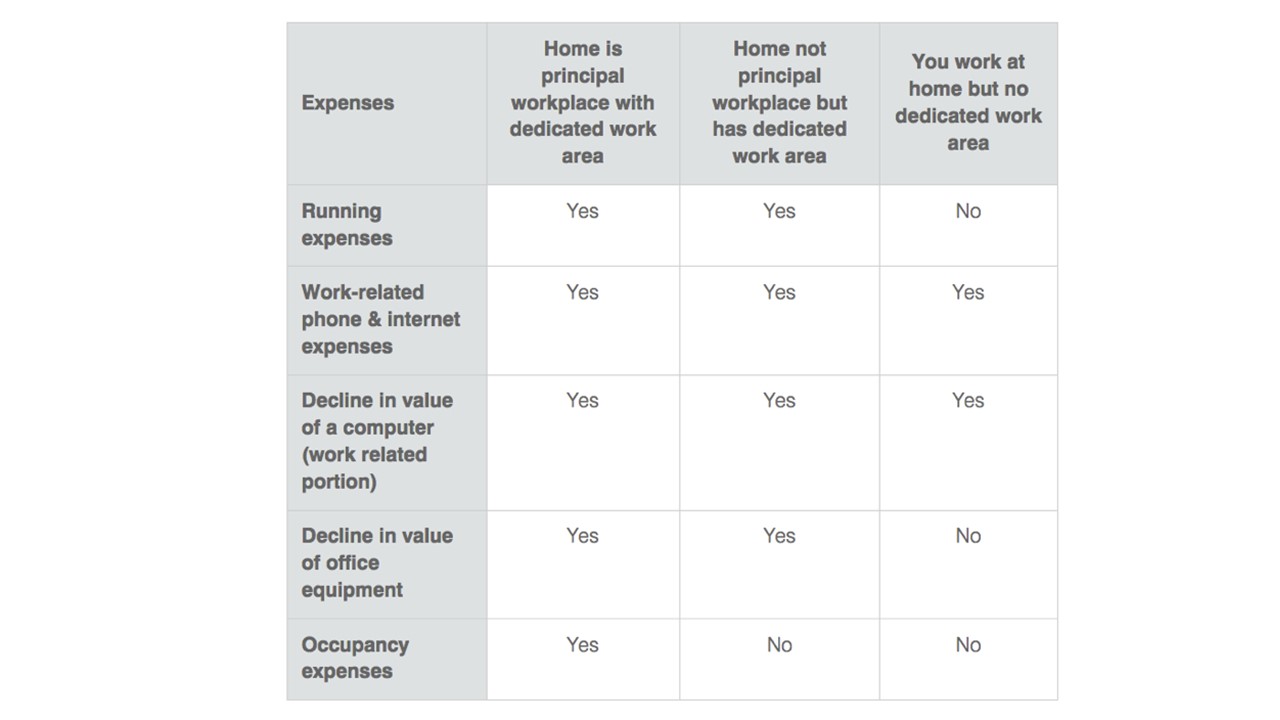

Below is a table from the ATO guidance that shows what can and cannot be claimed under the different working scenarios:

Home office running expenses include the following:

- home office equipment

- Electricity and gas expenses

- the costs of repairs to your home office equipment, furniture and furnishing

- cleaning cost

- printing and stationery costs.

There are two methods that an employee can use to calculate their home office expenses deduction:

- fixed rate method, or

- actual method

Under the fixed rate method, the deduction is calculated by multiplying the number of hours that you used the office for work during the financial year by the fixed rate, which is currently is 45 cents. The ATO requires that you maintain records of actual usage for the whole year or you can maintain a 4 week diary of the work usage of the home office that is representative of the whole year.

Under the actual method, you need to maintain records of all running cost expenses for the year and calculate the percentage of office floor space in relation to the total floor space of the house, which is then multiplied by the percentage of that you used the office for work during the year.

The only time an employee can claim a tax deduction for home occupancy expenses, such as rent, mortgage interest, insurance, and rates, is if an employer provides no other work location for the employee and the employee is required to dedicate part of their home to their employer’s business as an office. It is important to note that should you claim home occupancy costs as a tax deduction for part of your home then you will be ineligible for the use of the main residence exemption for CGT purposes on that part of the home when you sell it.

If you are running your business from home, such as a dentist surgery or hairdressing salon, the following expenses are tax deductable:

- utility expenses, such as gas and electricity – which must be apportioned between business and private use, based on actual usage

- business phone costs

- depreciation on the office plant and equipment, such as desks, chairs, computers – which must be apportioned between business and private use

- depreciation of the curtains, carpets and light fittings of the room that is being used solely for business purposes

- occupancy expenses, such as rent, mortgage interest, insurance, and rates – apportioned between business and private use based on floor area that is being used for business as a proportion of the whole floor area of your home.

Again, it is important to note that the full main residence exemption will not apply if your home is your principal place of business.

Share this:

Posted on by Christabelle Harris

Self Managed Superannuation Fund (SMSF) Trustees’ are required to consider whether to hold insurance cover for members of the fund and to document their considerations in the fund’s investment strategy.

The Trustee will determine whether insurance is appropriate by assessing each member’s needs in terms of age, income, health and dependants.

Rules came into effect on 1 July 2014 which aimed to ensure that where members hold insurance policies within super, they are able to access the insurance proceeds from their fund in the event of a claim. Therefore, the terms and conditions of the insurance policy must align with one of the following conditions of release:

- death (including a terminal medical condition),

- permanent incapacity, or

- temporary incapacity.

Trustees can consider multiple forms of Life Insurance, including Life Cover, Total and Permanent Disability insurance, and Income Protection.

Life Cover

Life insurance provides a lump sum to dependants in the event of death or diagnosis of a terminal illness. It can help increase the funds available to cover for loss of earnings and ongoing financial commitments.

The premiums are tax deductible to the SMSF, but not to an individual.

Please be aware that when proceeds from life insurance is paid from a super fund to non dependants, an untaxed element i.e 30% tax, is applicable in some circumstances where premiums are claimed as a tax deduction. If no deduction is claimed there is no untaxed element. The closer the deceased is to retirement the smaller the untaxed element.

Should you require further information on the definition of a non dependant, please contact our office.

Life insurance is available on its own or commonly, along with Total and Permanent Disability (TPD) insurance.

Total and Permanent Disability (TPD) insurance

Permanent Disability Insurance provides a lump sum if the insured person suffers Total and Permanent Incapacity.

Permanent incapacity, under Super Legislation conditions of release, means ill health (whether physical or mental), where the trustee is reasonably satisfied that the member is unlikely, because of the ill heath, to engage in gainful employment for which the member is reasonably qualified by education, training or experience.

An insurer generally defines total and permanent disability as:

- Any occupation – circumstances which leave a person unable to engage in gainful employment in any occupation for which the member is reasonably qualified by education, training or experience, or

- Own occupation – circumstances which leave a person unable to work again in their own occupation they held just prior to TPD.

Under Super Legislation the definition of permanent incapacity is for ‘any occupation’.

From 1 July 2014, super funds are generally prohibited from taking out ‘own occupation’ TPD policies on behalf of their members as a benefit may become payable under the policy, despite the fact that the member may still be able to engage in some other employment for which they were qualified by education, training or experience, and therefore would not qualify to have the payment released from superannuation.

‘Any-occupation’ TPD policy premiums are generally fully deductible to the SMSF.

For ‘own-occupation’ TPD policy premiums, the proportion of premium used to fund ‘any occupation’ component is generally deductible to the SMSF with the remainder not deductible.

Total and Permanent Disability Insurance can be Linked with Life Insurance or it can be a Standalone Policy.

Income protection insurance

Income protection insurance generally pays an income stream for the purpose of continuing (in whole or part) the gain or reward which the member was receiving immediately before the temporary incapacity.

From 1 July 2014 only ‘standard’ Income Protection insurance policies are able to be purchased by SMSFs and these must comply with the conditions for temporary disability payments under Super Legislation.

While policies purchased by a SMSF will generally provide cover where a member is unable to work at all due to sickness or injury, they will not be able to offer some of the additional features and benefits which policies held outside of super can, such as redundancy benefits and nursing and housekeeper care.

Also, income protection policies offered within SMSFs requires the member to be gainfully employed (including self-employed) at the time of suffering the incapacity.

Income protection premiums are generally deductible to the SMSF provided that the benefits payable under the terms of the insurance policy comply with the requirements of Super Legislation.

There is no tax advantage to holding income protection in an SMSF, as premiums are tax deductible both inside and outside of super. The benefit of a tax deduction is limited to 15% inside super, whereas it can be up to 45% outside of super.

Trauma insurance

Trauma insurance policies within the SMSFs are generally prohibited from 1 July 2014 as their terms and conditions do not align with one of the specified conditions of release under Super Legislation.

Prior to 1 July 2014

Prior to 1 July 2014, members of complying super funds were generally able to take out a range of life and disability insurance policies issued by a life insurance company within their fund.

The only requirement was that a trustee needed to ensure the acquisition of the policy would not cause the fund to breach the acquisition from related party rules and would be permitted under the sole purpose test and the fund’s governing rules.

Deciding whether to have insurance inside an SMSF will depend on a member’s individual circumstances and needs.

Please contact our Superannuation Manager Helen Cooper on 08 9316 7000 should you wish to discuss your specific circumstances in more detail.

Any information provided in this article is general in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and was not intended to imply any recommendation or opinion about a financial product. This does not constitute financial produce advice under the Corporations Act 2001.

Share this: