Posted on November 1, 2016 by Kelsi Keep

Q: Can I claim a deduction for home expenses if I work from home occasionally?

A: Yes, for your home office expenses you can:

- Use a fixed rate of 45 cents for each hour of work you perform from home. This rate is designed to cover the cost of heating, cooling, lighting and the decline in value of furniture in your home office.

OR

- Use the work-related proportion of the actual costs of the office. The deductions you can claim depend on whether or not you have a room such as a study or spare room that is set aside primarily or exclusively for work activities.

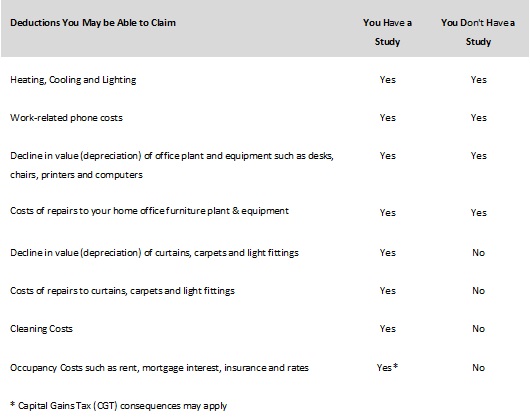

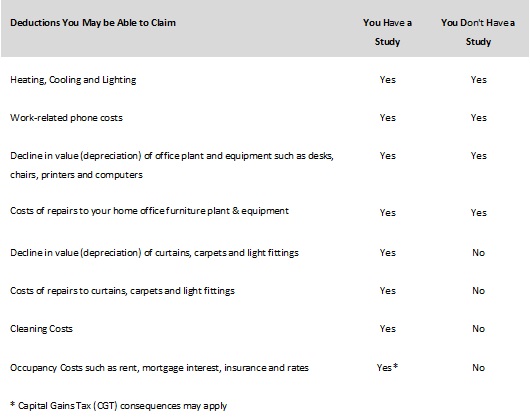

The following table sets out the deductions you may be able to claim:

Q: Do I need to keep any records in order to claim Home Office Expenses?

A: Yes, you must keep records of home expenses, such as:

- Receipts or other written evidence of your expenses;

- Itemised phone accounts from which you can identify work-related calls, or other records, such as diary entries if you do not get an itemised account from your phone company;

- A diary you have created to work out how much you used your equipment, home office and phone for business purposes over a representative four-week period.

Share this:

Posted on by Christabelle Harris

With Telethon breaking donation records and our Partner Charity Ronald McDonald House Charity Ball being held this month, it is a good time to discuss what constitutes a donation or a gift. Are the golf clubs I won in the silent auction for charity tax deductible? If I receive a pen with my donation is it still tax deductible? Are donations to a school building fund tax deductible?

In order for any gift or donation to be deductible it needs to be made to a Deductible Gift Recipient (DGR). This means the organisation is entitled to receive tax-deductible gifts and tax-deductible contributions. Unless an organisation is a DGR, the supporter/donor cannot claim a tax deduction for a donation or contribution made. It is important to keep this in mind especially when donating to Foreign Organisation as they may not be registered as a DGR for Australian Taxation Purposes.

An organisation can be a DGR with DGR endorsement or listed by name in tax law. Interestingly Political parties are not DGRs, donations made by an individual however may be tax deductible, entities carrying on a business that make donations are not tax deductible.

To be entitled to ATO endorsement, an organisation must meet several requirements including falling within one of the general DGR categories described in the tax law. Examples include public hospitals, registered public benevolent institutions and school building funds.

For a full list of the Deductible Gift Recipients the Australian Business Register has a full list in the link below:

http://abr.business.gov.au/DgrListing.aspx

DGR endorsement is determined by the ATO (or named in tax law). It is a legal endorsement that operates separately from charitable status. Although the vast majority of organisations with DGR status are charities, charitable status is not technically a prerequisite for gaining DGR status. Some examples of organisations that have DGR status that are not charitable are government-run institutes such as the Royal Children’s Hospital.

In order to claim your donation or gift to a DGR as a deduction, you cannot receive a material benefit in return for your donation. When you make a contribution, for example, purchasing a ticket to attend a fundraising dinner, you are receiving a benefit in return with the entertainment and or dinner provided. The golf clubs won in silent auction would also not be deductible donation.

Please also be aware that a gift/donation cannot add to or create a tax loss. However donors can choose to spread the tax deduction for a gift over a period of up to five income years. You may want to make an election to spread tax deductions over multiple years because:

- otherwise you may have a tax loss that prevents you claiming the whole amount;

- you earn a higher income in some years than others.

In summary when looking to claim a tax deduction for a Donation or Gift the following points need to be considered:

- The gift must be made to a DGR.

- The gift deduction claimed is the amount of money donated to a DGR.

- Retain receipts or records.

- Claim the tax deduction in the income year in which the donation is made.

- The deduction cannot add to or create a tax loss.

- The option to make a written election to spread the tax deduction.

Share this: